Saving Money: A Definitive Guide

Discover a Technique That Can More Than Triple Your Savings in Less Than 2.5 Years Without Increasing Your Self-Discipline or Willpower

Robert Kiyosaki, the famous author of Rich Dad, Poor Dad once said that “It’s not how much money you make, but how much money you keep, how hard it works for you and how many generations you keep it for.”

Millions of people in South Africa and globally know how accurate this Kiyosaki’s observation is.

Saving money sets the foundation for achieving many goals, financial and otherwise. But why is it so hard to save money?

You’ll discover the answer to that question in this article.

Moreover, you’ll learn about a technique that has been proven to work to save for retirement that you can use to double your savings in less than 3 years, how to increase your savings, and where to keep your savings.

Before we get started, you can choose to go directly to the chapter that interests you the most by clicking on it below

Chapter 1: Why Should You Save Money?

I’m sure you’re better positioned to answer why you need to save money. However, there are certain financial goals that are universal.

And I’d like to share with you some of them, beginning with this…

It’s a Powerful Means to Become Financially Free

Imagine how your life would look if you achieved financial freedom! Although financial freedom means different things for different people, there is one common thing.

You don’t worry about money anymore.

If an emergency occurs, you’re covered. If you want to travel to any country in the world, you can do it anytime you want.

For some, having financial freedom includes working a job because they want to, not because they are forced to. They have the freedom to pursue their passion.

To achieve financial freedom, you need to develop the right habits. One of those habits is saving consistently. The good news is that there’s no law that says you should start saving at a certain age. However, the sooner you start, the faster you can reach financial freedom.

Before you begin to save, write down at least 10 reasons why financial freedom is important to you. If you can come up with more, the better.

Put your list in the order of priority.

How much do you need to be financially free? This is a crucial question. Only you know the answer. Remember to consider your living expenses and inflation when you work out your financial freedom number.

It Helps You Handle Financial Emergencies

In 2022, Old Mutual published the results of its survey called the Old Mutual Savings and Investment Monitor (OMSIM) survey.

One of the questions in the survey asked: “If you were retrenched or lost your job, would you have enough money saved to last you …,” and the respondents were given four options: 1 month or less, 2 months, 3 months, and more than 3 months.

The results?

A similar survey in 2019 revealed almost similar numbers:

If you were part of the participants in this 2022 survey, what option would you have chosen?

The reality is that the majority of South Africans live almost from hand to mouth. If a financial emergency occurs, we are forced to get into debt.

This can include credit cards, personal loans, or informal debt like loan sharks.

However, if we start saving or increase our savings, we can better handle unforeseen financial commitments.

It Improves Your Mental Health

Sadly, your car insurer decides not to cover you because you failed to maintain your car regularly.

You’re now sitting in a situation where you have no car to go to work. Perhaps this has left you with no school transport for your children.

Imagine how this situation will impact how you think!

For many of us, this will cause distress if not stress, especially if we don’t have enough savings to buy a new car. Yes, we can buy a new car on credit, but that digs us deeper into the debt hole.

If this situation happened when we had enough savings, we could perhaps afford to buy another car, even if it’s a used car. Alternatively, we could make a large deposit for a new car to minimise the size of the car loan we take.

Simply knowing that you’ve saved money changes the way you think, even in difficult financial circumstances.

You don’t have to worry about where you’re going to find the money to cover many of your expenses. For instance, if you lost your job, you know you have a financial cushion to last you until you land a new one. This alone makes the task of finding a new job less stressful.

When you save money, you’re also saving or improving your mental health. In turn, you’ll do other things in life much better.

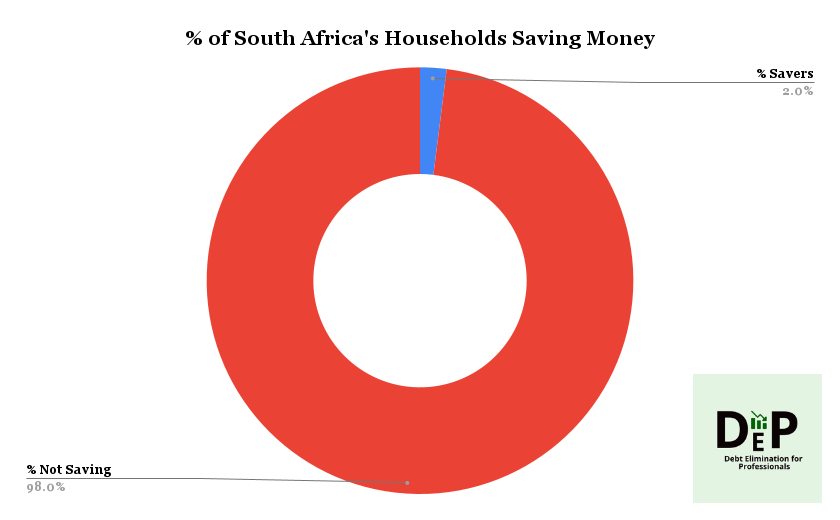

Chapter 2: Why More Than 98% of South Africa’s Households Don’t Save Money

Saving money is supposed to be easy, right? After all, you simply cut a portion of your salary and stash it somewhere. Yet, less than 2% of South Africa’s households are doing it while many of us struggle to do it.

This trend has been continuing since at least 2005, according to Trading Economics.

Why?

In this chapter, you’ll discover the major reason many households fail to save money. As you go over these reasons, check if they apply to you. When you find one that applies to you, resolve to fix it.

Let’s get started with the first reason.

1. Money-Spending Is Easy

Technology has advanced so much that all you need to buy something is a credit or debit card.

Many decades ago, you went to a shop and the shopkeeper stood behind the counter. You handed him or her money and mentioned what you wanted. He or she strode to the shelves, picked up what you wanted, gave you change (if any), and you left.

Today, the shelves are open to us. We go to the shop, pick up what we want, pay, and leave. In some shops, you can even pay for your goods by using an automatic point-of-sale system—no more cashiers.

Do you see how easy it has become to spend money?

Additionally, there are credit and debit cards that make buying as seamless and simple as possible.

Researchers have been fascinated by consumer behaviours when given choices of paying with credit cards or cash. A case in point is a study by Drazen Prelec and Duncan Simester, professors at Massachusetts Institute of Technology (MIT) titled Always Leave Home Without It: A Further Investigation of the Credit-Card Effect on Willingness to Pay.

These researchers concluded that “willingness-to-pay is increased when customers are instructed to use a credit card rather than cash.”

Not only that. Credit card purchasers are willing to pay a premium if needed.

When paying by credit card, it appears as if you are not spending money—you’re getting the item for free.

Logically, this doesn’t make sense. However, the emotions we experience when buying can overcome the power of logic. Usually, such emotions lead to what psychologists call impulse buying—purchasing unplanned-for things. And this can, and does, cause money troubles.

Ian Zimmermann, an experimental psychologist, puts his perspective on impulse buying this way in Psychology Today, “Impulse buyers tend to experience more anxiety and difficulty controlling their emotions, which may make it harder to resist emotional urges to impulsively spend money.”

2. Over-Indebtedness

It’s hard to live modern life without debt. The problem occurs when we’ve taken on too much debt and barely buy anything in cash. Consider this:

More than half of South Africans are over-indebted. It’s sad that about 54% of the credit money is used to fund basic needs such as food and clothing.

More than 40% of high-income earners borrow money to fund food, clothing, transport, and regular bills such as electricity.

When you’re over-indebted, most of your money goes toward paying debt. Little is left to cover for emergencies and to save for your financial goals.

As a result, you’re forced to keep borrowing to be able to put food on the table.

This kind of life is stressful and can cause depression. Whether you’re a low-income or high-income earner, financial stress can lead to depression.

3. Chasing an Expensive Lifestyle

So, how much you earn doesn’t mean you’ll succeed financially. But why? The answer lies in our consumption patterns.

Many think that a high income is a licence to wear expensive clothes, drive luxurious cars, live in upscale homes, and take their children to expensive private schools. This is fine if that’s what such a person wants.

However, if it contributes to financial struggle, it’s not OK.

One of the big factors that lead to living an expensive lifestyle is social pressure. Simply because your subordinate has bought a luxury home or car doesn’t mean you should follow suit.

You don’t know how they manage to pay the instalment. What if it’s a gift from someone such as their spouse?

A lifestyle of consumerism rarely leads a person to financial freedom. Instead, such an approach to life ends up trapping you in debt.

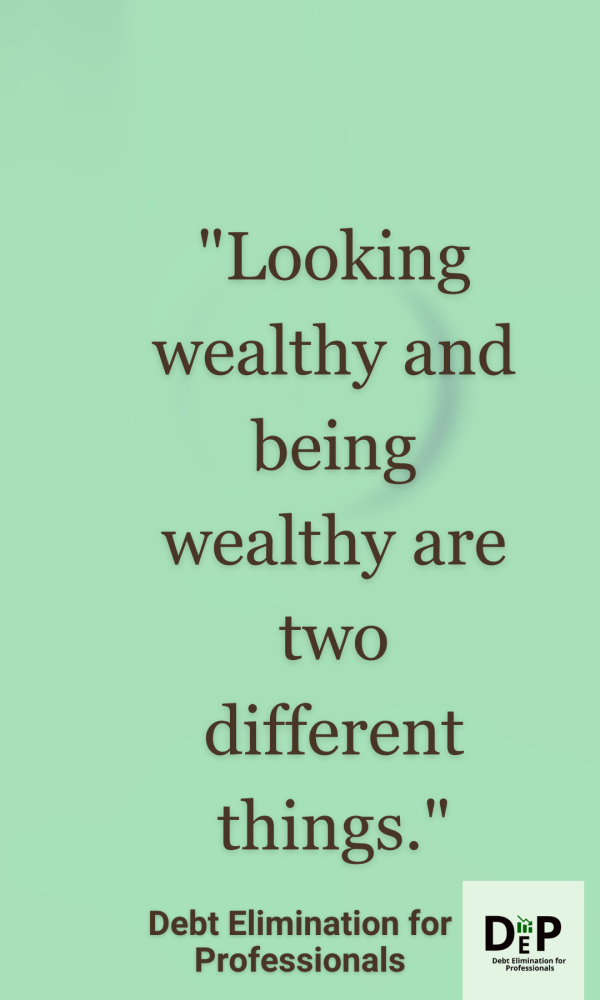

One of the main reasons for living an unearned high life is the myth that income is wealth. We, somehow, believe driving a luxurious car means we’re wealthy. Yet, we borrowed money to buy that same car.

Looking wealthy and being wealthy are two different things. Let me repeat…

Looking wealthy and being wealthy are two different things…

Often, it’s the high income we earn that breaks open the gates to increased debt and allows quick access to credit. And that begins a life filled with financial troubles.

The antidote is to break free from living an accidental lifestyle and live a carefully designed lifestyle. Yes, you and I can design our lives.

4. Procrastination

This is known as Newton’s first law of motion in physics.

This is true as much for inanimate objects as it is true for humans. Not saving is a habit and it requires mental strength to overcome that kind of behaviour. Unless you force yourself (apply a net force), you’ll keep not saving.

Even if you tell yourself that you’ll start saving next month, it’s rare that you’ll make it a habit. You may save next month but not follow through the month after.

We procrastinate because it’s hard to start saving—it’s tough to begin a new habit. It requires a powerful reason for saving and understanding of a principle I discuss in the next chapter.

5. Not Budgeting or Not Reviewing Your Budget

Imagine that you could have everything that you want in life. Write 20 of such items on a piece of paper.

Next to each item, note how much you’ll pay for it monthly. For instance, suppose the first five items on your list are:

- BMW X5: R25,000 per month

- A 3-bedroom double-story house with a wine cellar in Sandown, Cape Town: R50,000

- Travel twice a year to foreign countries: R5,300 for flights only

- New clothes every month: R5,000 monthly

- Philanthropy: R10,000 a month

The total cost of the above items is R95,300 monthly. It’s just a small portion of what you want and need. Imagine how much you’ll need each month to buy or pay for everything you need and want!

The truth becomes clear.

Your income is way less than the total cost of all the things you want or need.

It follows that you have to choose which of those items to buy. This requires an income spending plan. Unfortunately, many people who don’t save do not have a budget.

Thomas Stanley and William Danko carried out a 20-year study to figure out what made some Americans wealthy while similar others aren’t.

One of their major findings is summed up by the following quote from their book The Millionaire Next Door: The Surprising Secrets of America’s Wealthy:

“They became millionaires by budgeting and controlling expenses, and they maintain their affluent status the same way.”

Since savings come from your income, they need to be part of your budget. If you don’t have a budget, saving will be hard.

If you have a budget, and you aren’t saving, perhaps saving is not yet important enough for you. In case saving is important, and you are not saving, you’re probably not reviewing your budget consistently.

It’s a great move to create a budget. Creating a budget doesn’t seem to be a big issue for 54% of South Africa’s households, as discovered by the Financial Sector Conduct Authority (FSCA).

However, unless you review it regularly, you won’t spot what you’re doing wrong financially. You’ll keep leaking money and not even knowing where it disappears.

Many people rely on mental accounting to handle their finances. This practice of categorising your expenses and making buying decisions doesn’t work for many of us.

Its biggest weakness is that it’s hard to review your budget, spot poor financial decision-making, and adjust your future spending. The good news is that anyone who is willing can create and review their budget, which will transform their financial life and help them save money regularly.

Dr. Thomas J. Stanley and his daughter Sarah Stanley Fallaw confirm this in their book The Next Millionaire Next Door: Enduring Strategies for Building Wealth when they say:

“So long as the freedoms that we enjoy exist in the United States, there will be individuals who will build wealth, not because of luck or the color of their skin or their parents’ success, but because of the goals they set, the behaviors they employ to reach their goals, and their ability to ignore distractions and naysayers along the way.”

This also applies to us South Africans.

We in South Africa have ample opportunities to escape financial hardship, build wealth, and become financially free. All this begins with altering our mindsets regarding affluence.

Chapter 3: The First Thing to Do to Win in Saving Money

Look at the resulting diagram and guess what’s common among those reasons.

If you’ve found the right answer, that’s great. Don’t worry if you haven’t spotted the commonality because I’m about to reveal it.

The common factor amongst all those reasons is YOU. In my case, it’s ME.

The message is clear: If you stay the same person you are, the chances of regularly saving money are small.

If you’re tired of always having to get into debt to cover unforeseen expenses and reach financial freedom, you have to do one thing…

Take responsibility for your finances. Be at the centre of your financial life and take the lead.

Why Taking Financial Responsibility Is Key to Financial Success

So, how much you earn doesn’t mean you’ll succeed financially. But why? The answer lies in our consumption patterns.

Many think that a high income is a licence to wear expensive clothes, drive luxurious cars, live in upscale homes, and take their children to expensive private schools. This is fine if that’s what such a person wants.

However, if it contributes to financial struggle, it’s not OK.

One of the big factors that lead to living an expensive lifestyle is social pressure. Simply because your subordinate has bought a luxury home or car doesn’t mean you should follow suit.

You don’t know how they manage to pay the instalment. What if it’s a gift from someone such as their spouse?

A lifestyle of consumerism rarely leads a person to financial freedom. Instead, such an approach to life ends up trapping you in debt.

One of the main reasons for living an unearned high life is the myth that income is wealth. We, somehow, believe driving a luxurious car means we’re wealthy. Yet, we borrowed money to buy that same car.

Looking wealthy and being wealthy are two different things. Let me repeat…

Looking wealthy and being wealthy are two different things…

Often, it’s the high income we earn that breaks open the gates to increased debt and allows quick access to credit. And that begins a life filled with financial troubles.

The antidote is to break free from living an accidental lifestyle and live a carefully designed lifestyle. Yes, you and I can design our lives.

The word “responsibility” means that you recognise that the buck stops with you. If your finances are not in order, you are the reason. The same applies if your money life is great.

Responsibility means the ability to respond. It doesn’t mean preventing some things from happening but it’s about what you do when those things take place.

If you’re over-indebted, you don’t look for someone else or something to blame. You look at what actions you can take to manage the situation.

A financially responsible person doesn’t blame their low income, boss, or spouse when they don’t save enough. They ask themselves why they are not saving and look for solutions.

As I was writing this article, I bumped into a book by Jay Abraham and Masumi Shimafuji called No Limit – The Limit Is Only In Your Brain. In it, this quote caught my attention:

“If you do not become the director of your own life, your life will end up being managed and controlled by somebody else. And you will end up going through life living according to what someone else has decided to be a good way to live.”

I can replace the word “life” in the above quote with the word “finances” and still be dead accurate.

If you don’t take ownership of your financial life, someone else will do it on your behalf. The problem is that you won’t like the results.

When you assume financial responsibility, you’ll do certain activities, including the following:

Living Within Your Means

You objectively look at your income and spend less than you earn. If you desire to buy something, it’s OK. Simply raise the money first and then go and buy it.

To live within your means, you’ll have to create and live by a budget.

You can do this even when you want to buy a high-ticket item such as a car. The only difference is that it may take you a couple of years to raise the money you need.

Setting Financial Goals

As I mentioned above, impulse buying derails financial success. One powerful method of preventing this is setting financial goals and then allocating a certain portion of your income to achieving those goals.

Make sure that you write your goals down on a blank piece of paper and place it in your wallet or purse.

A study by Dr. Gail Matthews of the Dominican University of California has found that people who write goals down achieve significantly more than those who don’t.

Each time you open your wallet or purse, you’ll remember your goals. And your mind will work tirelessly behind the scenes to help you achieve those goals.

Chapter 4: The Hands-Free Money-Saving Technique for Effortless Saving

Would you like to use a proven method to save regularly and reach your financial goals? There’s such a method, and I call it the Hands-Free Money Saving technique. This chapter is all about how it works and most importantly, how to make it work for you.

In case you doubt, here’s proof that this incredible technique works.

Tip: Your employer might be using it to beef up your retirement savings… and I’m sure it’s working.

The Case for the Hands-Free Money-Saving Technique

In January 2008, I joined Palabora Mining Company, a copper mining company in Phalaborwa, Limpopo, South Africa. The company didn’t give me a choice whether to opt-in to save for retirement or not.

It was mandatory. And I’m glad that happened because I accumulated more than half a million rand over a six-and-half-year period. It’s not much to write home about but I’ll take it every time compared to receiving nothing.

Why did this automatic retirement savings enrollment work? Simply because I was not given a choice. The only time to withdraw the savings was if I resigned or retired… (Someone else would have withdrawn the savings had I died before cashing them).

Because of this automatic enrollment, I had to adjust to living within the salary that remained. I doubt if I would have saved much had the company given me the option of NOT contributing.

The problem is the lack of self-control that’s typical of many professionals and ordinary people.

Automatic enrollment to retirement savings has been demonstrated to work even in countries such as America.

Four professors, two from Harvard University and two from the University of Pennsylvania’s Wharton School confirmed that automatic enrollment in a 410(K) retirement plan.

In their research For Better or for Worse Default Effects and 401(k) Savings Behavior, they found that automatic enrollment increased employee participation.

For instance, in the three companies they studied, automatic enrollment increased 410(k) participation to more than 85%—irrespective of the employee’s length of employment.

This was a huge improvement from the average of between 26% and 43% six months after new employees joined the companies.

For employees who stayed with the companies for three years, the average was between 57% and 69%, and the jump to 85% is still significant.

The improved 401(k) participation was realised despite employees having the option to opt-out. This is incredible, isn’t it?

Why can’t we regularly save? The answer is simple: Conscious saving requires self-discipline, which in turn, depends on your willpower.

In contrast, automatic money-saving is hands-free and doesn’t require you to be as tough as steel to achieve your savings goals.

How many choices do you make daily? We make thousands of decisions per day. Out of these, more than 200 decisions are about food, according to one study published in the Journal of Environment and Behavior.

Some of these decisions occur in the hidden areas of our minds.

When faced with thousands of decisions, we rely on our subconscious mind for automatic choices. The decisions we consciously have to make end up in the dustbin of the to-do list.

Sadly, the decision to save falls in the latter category for millions of people in South Africa and abroad.

Enter the hands-free money saving (HFMS) technique and you won’t have to worry about saving money anymore. Technology will do this for you while, at the same time, you develop the habit of saving.

If you aren’t convinced yet that the HFMS technique works, let me offer another piece of evidence.

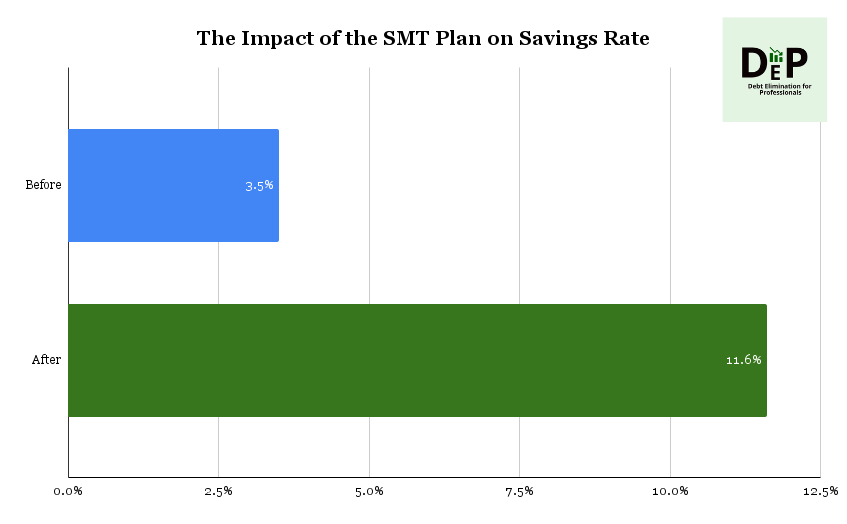

In August 2001, Richard H. Thaler of the University of Chicago and Shlomo Benartzi of The Anderson School at the University of California, Los Angeles (UCLA) published a paper titled Save More Tomorrow: Using Behavioral Economics to Increase Employee Saving.

The Save More Tomorrow (SMT) plan is a prescriptive retirement saving plan these researchers proposed. In its first implementation, they found that 80% of the participants remained in it through three annual pay increases.

Most importantly, the participants increased their savings rate from 3.5% to 11.6% over a 2.25-year period. The new savings rate was nearly three and a half times the initial rate, which is staggering.

If you want to save regularly, then it’s time to take advantage of the HFMS technique.

How to Use the HFMS Technique

Imagine that you’re 35 years old and work a corporate job. You receive your salary at the end of each month. Now, you want to apply the HFMS technique to build a saving habit while making strides towards achieving your financial goals.

How do you set up your savings to go off automatically? It’s a simple process.

The first step is to ensure that you receive your salary directly into your transaction account such as a cheque account.

If this isn’t the case, contact the payroll department of your employer and fill in the appropriate form.

With that out of the way, let’s continue with the setting up process of saving automatically.

Let’s assume that you want to save for three goals: a 10% deposit for a car, an emergency fund, and education for your children. With this in mind, you need to have three different savings accounts. This is easy to accomplish if you open an online savings account.

Your main account lets you create additional savings accounts. This is the account you can use to receive your salary. The number of extra accounts you create will depend on your bank. Let’s say that your bank allows you to create four extra accounts.

The first step is to create a savings account for your first goal. Let’s call it Car Deposit, and the next two accounts will be Emergency Fund and Education Fund.

Your next step is to set up automatic transfers between your main account and each of your three savings accounts.

Open your bank’s app and locate an option such as Transfer Money or a similar feature. When you tap it, it lets you set the “From” and “To” accounts.

Make sure that the “From” account is the one you receive your salary in. The “To” account should be the Car Deposit account.

Scroll down and enter the amount to transfer each saving period. Even if you can’t afford to save the amount you want, enter a figure you can save consistently. What’s more important is building the habit of saving.

Next, set the “Transfer Type.” This is where you can choose the “Recurring” option and set the frequency of your transfers, which can be weekly, bi-weekly, monthly, and other options.

Enter the start and end dates of the recurring transfers. If your bank’s app doesn’t allow you to choose a specific date for the transfer to happen, do this setup on the day you want it to go off.

For instance, if you want the transfer to occur on the 6th of each month, create this setup on the 6th.

Tip: Set the transfer date to two or three days after receiving your salary. This will give you a chance to suspend a given automatic transfer in case there’s a salary delay.

When done with setting the dates, tap the “Transfer” button to complete your setup.

Repeat the above process for each of the two remaining savings accounts.

How do you apply the HFMS technique if you receive your salary bi-weekly? Simply adjust the transfer dates and amounts. Instead of one transfer, you’ll have two transfers per month.

Chapter 5: What Type of Savings Account to Use

You’ve decided that saving money is key to achieving your financial goals. What kind of savings account will be ideal to stack your money in?

The answer isn’t as straightforward as you may think.

There are pros and cons of each type of savings account, which are important to know to make a well-informed decision.

In this chapter, you’ll learn what a savings account is, the types of savings accounts, and their pros and cons. Let’s get started.

A Savings Account Explained

A savings account is an account that pays interest on the money you have in it. Most savings accounts pay modest interest rates but they’re great tools for keeping your money safe.

The South African Reserve Bank (SARB) has created a new scheme to protect your savings for up to R100,000 per account per bank. The newly established scheme is called the Corporation for Deposit Insurance (CODI).

All 17 member financial institutions of the SARB are part of this scheme. This means that if you have R1 million in savings and you want it insured, you may have to open 10 savings accounts with different SARB member banks.

Savings accounts come in various flavours. For instance, some require minimum balances while others don’t. Additionally, some savings accounts offer better interest rates.

The interest you earn on your savings is treated as income for tax purposes. This means that your financial institution will send you a tax certificate for use when filing for income taxes.

One of the advantages of savings accounts is that you can access your money on short notice. With some accounts, you can withdraw money immediately when at an ATM by using a debit card.

If you want to purchase online or in shops, you can pay with your debit card. However, not all savings accounts offer this convenience.

A savings account is easy to link with your cheque account and implement the HFMS technique. This is a great idea if you receive your salary in a cheque account.

Another advantage of a savings account is that you can have two or more of them at the same financial institution. You can use each of the savings accounts for a specific financial goal.

For instance, you can have a savings account for emergencies, one for vacation, and another for a car deposit.

While easy access to your money is a benefit, it can also be a challenge. You’ll need to be disciplined and avoid withdrawing your savings before reaching your financial goal.

Types of Savings Accounts

The choice of a savings account depends largely on your financial goals. Your goals will typically be of short-term or long-term nature. Here are two kinds of savings accounts you may consider using besides regular savings accounts.

Notice Deposit Savings Accounts

If you want to fight the urge for impulsive buying, then a notice deposit account can be a good fit. Let me explain.

Saving money isn’t easy, especially if you’re not yet in the habit of doing it. When you do save, you sure would like to reach your savings goal.

However, there are many opportunities for wanting to drain your savings. For instance, you may want to buy that iPhone you’ve been dreaming about on Black Friday or Christmas.

That’s fine if you’ve specifically budgeted for that kind of purchase. However, the idea to buy that item may have sprung up because you know you have some savings stashed somewhere.

If this money is easy to access, you can withdraw it and buy that iPhone.

This is where a notice deposit account can save you from making such mistakes. Instead of accessing the money immediately, you have to give your bank a notice, which can range from seven to 60 days.

The longer the notice period, the better. This is because the notice period will give you time to cool those buying emotions.

At the end of the day, you may even cancel the notice to withdraw funds. Isn’t that a good thing?

You’ll be glad to know that the interest you earn in these kinds of accounts is better than in regular savings accounts. This means that your money will grow faster.

Additionally, you can deposit funds regularly in your notice deposit account. So, if you can get a nice tax refund, you can divert half of it to this account.

Notice deposit accounts are great to use to achieve your medium-term goals.

Let me give you a neat trick for using a notice deposit account for emergencies. For this, you need to have a credit card and use it like a debit card. Here’s how the trick works.

Set the notice period to seven days. When an emergency occurs, send the notice to withdraw as soon as possible. Then, use your credit to cover the expenses for the emergency.

Make sure that you have more than seven days before your credit card issuer charges interest.

When you receive your savings, pay off the credit card. If you do this properly, you won’t be charged any interest on your credit card as it’ll have a zero balance.

Did you get it? Good.

Money Market Accounts

Another type of savings account you can open is a money market account or call deposit account. Interest earned is generally higher than in a regular savings account but lower than in a notice deposit account.

You know upfront what interest rate you’ll earn, which is great for predicting how fast your money will grow.

It’s important to reiterate that saving money isn’t primarily about growing money but to develop a foundational habit for achieving your financial goals.

This type of savings account allows you to ask for your money on short notice: You can receive your money the same day or the following day.

It follows that a money market account is great to use to save for emergencies.

The drawback is that a money market account offers lower interest rates than a notice or fixed deposit account.

You’ll need to have at least R10,000 to open a money market account. When you withdraw, you’ll be charged a transaction fee the same way as any other savings account.

Chapter 6: Should You Pay Off Debt or Save First?

Many of us were raised in families in which money rarely formed an agenda during dinner discussions. I wonder how our families would react if we brought up the subject of debt and money when enjoying dinner.

Yet, whether we should pay off debt first or save first is paramount. In this chapter, we’ll explore it and reach a reasonable conclusion… And you’ll know, without a doubt, what’s best for you.

How to Decide What to Do

When deciding which is better paying off debt or saving first, many people will tell you to pay off high-interest debt first. It’s understandable because this kind of debt costs you a lot of money. Let me explain.

Suppose that you have a R20,000 personal loan that charges you 20.25% in interest per annum. Let’s also say that the repayment will be 5 years. Your monthly instalment will be R532.66.

Over 5 years, you would have paid R31,959.60, which means the interest paid will be R11,959.60. These figures exclude insurance and other expenses such as the loan origination fee. Remember that a personal loan is an unsecured loan, hence the need for insurance.

If you decide to pay off this debt first and not save, you could save on the interest paid provided you pay extra.

For instance, if you pay R135.89 extra each month, you’ll settle your personal loan in 3.5 years. The good news is that your total payment comes down to R28,079.25, saving you R3,880.35.

This amount is nothing to sneeze at. It seems logical that you should pay off debt first.

But there’s a catch…

Tell me. What will happen if you need money quickly during the 3.5 years while paying off your debt?

You’ll probably have to apply for more debt. It’s therefore easy to get trapped into making debt payments.

Lenders won’t mind this. I’m sure a situation like this would worry you, wouldn’t it?

Think about this for a moment. Why do we have debt in the first place?

The answer is simple. We want to cover expenses we don’t have cash for. For example, to cover costs for an emergency such as medical bills or to pay for an item we want to have as soon as possible.

In short, we borrow money because we need or want it. If we had it, we wouldn’t borrow it, right?

The next crucial question to answer is why don’t we have money when we need it. For many of us, it’s because we don’t save at all or we don’t save enough. Additionally, we have no or limited means to protect ourselves financially.

For example, perhaps you don’t have the right kind of car insurance. One day, you’re driving and accidentally your car’s rear wheel comes off and the car veers off the road and smashes into someone’s stationary car.

Meanwhile, the wheel that came off knocked down a pedestrian and caused multiple injuries. If you have no or inadequate car insurance, the costs associated with this incident could fall on you. Not knowing any other way to cover these costs, what do you do? You borrow money.

It follows that while paying off debt, we should also financially protect ourselves against unforeseen or emergency expenses. That’s why creating and funding a Debt Prevention Fund (DPF) or what many call an emergency fund is an important financial decision you can ever make.

If you don’t have a DPF, you should save and pay off debt at the same time. Doing one or the other isn’t a good option because you’re financially exposed.

Choosing to save first means that your debt will be accumulating due to interest added. By the time you restart paying it, it may be so big and seem impossible to pay off.

On the other hand, opting to pay off debt leaves you open to borrowing more when you meet with emergencies or other major financial needs.

How Much Should You Save in Your DPF?

You’ve established that having a DPF is crucial. How much you set aside varies from person to person or from one household to another.

Most people or households need to have money set aside for living expenses, home repairs, appliance repairs or replacements, and car repairs.

Let’s briefly look at how much you should save for each of these expenses.

Living Expenses

How long would it take you to land a new job if you were to be fired from the current one? It depends on the existing job market, your experience, and your type of skills.

However, it can take at least six months to find a new job. This means you’ll need to have at least six months’ worth of living expenses to be adequately protected.

Living expenses include groceries, school fees, transportation, utilities, health care costs, and insurance. If you spend R10,000 monthly on living expenses, you’ll need to have R60,000 set aside for these costs.

Car Repair Expenses

I get that you may have car insurance to cover unforeseen car damages. However, you’re not going to claim for any and all car damages that you incur.

For instance, if your car incurs damages that cost R4,800, would you claim from your insurance if the excess is R5,000? I doubt if you will do so. It’s best to pay for the damage from your pocket.

If you have no such money stacked away somewhere, you could end up borrowing.

Your best bet is to save at least money equivalent to your auto insurance excess plus expenses such as wheel repairs and windscreen replacement.

Home Repair Expenses

If you’re still paying a bond or mortgage, you should have homeowners insurance. This insurance will cover damages or loss due to theft, vandalism, fire and other perils stated in your policy.

Remember that your insurance company will ask you to pay a certain amount called excess or a deductible. The higher this figure is, the lower will your monthly premiums be.

Household Appliances Repair Expenses

Life can be hard if you suddenly are without a fridge, stove, or geyser. You can go into debt to replace either of them if it dies. The problem is that you may have a large list of important appliances. If they have to be replaced within a short time, it can cost several thousands of rands.

Now, if you don’t have money set aside to replace them, your lifestyle will take a hit.

Saving money to replace them should be a no-brainer. To get started with saving, write a list of your appliances according to priority.

At the top, note down the name of your most important appliance. If you have some appliances that are in pairs, such as fridges, they’ll take a lower priority.

Estimate how much you’ll need to replace the top three.

Now, add up the totals of the groups of expenses explained above to come up with an estimated size of your DPF.

From this figure, estimate the time needed to build the fund based on how you can afford to save monthly.

For instance, if the DPF you need is R50,000 and you can afford to save R2,000 monthly, it’ll take 25 months to fully fund your DPF.

Now, follow the HFMS technique to ensure you save regularly. What if your current expenses use up your entire salary?

The next chapter provides ideas that might work for you.

Chapter 7: Tips to Accelerate Saving Money

If you’d like to increase your savings and reach your financial goals faster, you’ve got to read this.

I’m not going to ask you to cut your expenses…because your brain will revolt and may prevent you from saving at all.

Instead, what I’ll share with you below focuses on the future.

Without much further ado, let’s get moving.

Tip #1: Cap Your Debt

Debt is one area that chews a lot of money. Because it’s easy to get into debt, many of us find it hard to escape it, for good.

It requires self-discipline to get out of it.

The simplest method of minimising debt is to cap how much you can borrow. Not according to creditor standards, but by your own standards.

For example, you can decide that you’re not going to spend more than 45% of your net salary on debt repayments.

If you aren’t at that level yet, resolve to reduce your debt to your desired maximum level.

How about buying new things going forward? Should you buy them on credit or cash? You pay cash. Here’s why.

You see, we have a tendency to increase our spending when our salaries rise. It’s not that we spend the money on necessities but we mainly purchase nice-to-have things.

We upgrade cars when our current vehicles can still do a great job. Many of us buy newer iPhones to feel the part.

This lifestyle contributes a huge deal to our financial struggles.

You can still buy new cars, iPhones, luxury couches, etc., but you should decide to buy them for cash.

If you don’t have the cash when you want it, practice delaying your gratification and saving to make your purchase for cash.

For instance, if you decide that you want a car valued at R900,000, you need to first save that amount.

If you give yourself a year to buy it, you’ll need to save R75,000 a month.

What if you can’t save that much? Isn’t that a sign that you don’t afford such a kind of car? Perhaps it is.

If you believe you must have that car, give yourself 30 days before you make up your mind whether to buy it or let it pass. It’s not unusual to wind up deciding against making the purchase.

However, if you end up deciding to buy it, do so with new money—not new credit.

The good news is that there are many other ways of making money besides a salary. You can find other sources of income to save enough to buy it.

This trick that I’ve given you will make a huge positive difference in your financial life. Implement it and you’ll thank yourself immensely.

Your family will be glad that you made such a decision.

Tip #2: Negotiate… Everything

One of the fastest methods of increasing your savings is by cutting your expenses. However, you can only reduce your living expenses by X percentage and have no room to go further.

If you’d like to increase your savings by as much as is practically possible, you’ve got to think about skyrocketing your income. This is where your negotiation skills will come in handy.

From now on, make it a rule that you’re going to negotiate every major purchase you make.

Some of the items whose prices you can negotiate include furniture, a home, a car, insurance, and many other products and services.

Services can be a ripe place to pay lower prices than the majority of people. For example, you can negotiate carpet cleaning, landscaping, accounting services, and many more services.

What if you’re not yet skilled at negotiating? Can you still negotiate? Absolutely. In fact, whether we’re aware of it or not, we’re always negotiating.

Have you ever discussed task priorities with your spouse or child and found common ground? If so, you can negotiate.

Have you ever discussed which school to take your kids to with your spouse? If so, you were negotiating.

Negotiating doesn’t mean you’ll always get things in your favour. It’s a win-win process.

For instance, if you buy a phone valued at R5,000 for R4,000, both you and the retailer won. The retailer was happy with selling the phone for R4,000.

You were pleased to pay that figure.

It was a win-win.

Many of us go to the negotiation table without doing adequate preparation. Ultimately, we wing it.

Your next negotiation will be different. Because I present to you a step-by-step process to follow to make sure that you increase your chances of getting what you want.

Do you want a salary raise?

Are you looking for a job promotion?

Do you want to negotiate a salary offer for a new job?

For any of the above situations—and any others that require negotiation—the following process will come in handy:

Step 1: Conduct Your Research

This step is easy for many people to ignore and yet, it’s the most crucial step for any negotiation.

It involves figuring out your goals and objectives for negotiating. This should include determining the most-desired goals and least-desired goals.

You aren’t done without figuring out your best alternative negotiated agreement, often called BATNA.

The above are your reasons for negotiating and apply for anything you negotiate. Some negotiations will require intense preparation while others won’t.

The most important research is about your opponent. It’s crucial to research and understand them.

Figure out what’s most important for them. For instance, a car dealer wants to sell cars at the highest prices possible.

They want you to pay the highest price possible for the car you buy from them. Obviously, your desire conflicts with that of the seller and you’ll need to find common ground.

In your research, find out what price others similar to your opponent are charging. If you can, get quotations. These will give you an advantage when you negotiate.

In fact, they give you the ammunition to move your money to someone else. This is powerful because most sellers want customers.

Some know that they can keep customers for longer and make more money over time. The money you pay to a given over time is called the lifetime value (LTV) of a customer.

Step 2: Make an Offer

In many cases, you’ll be the first to make an offer. Typically, you’ll make a lower offer if buying something. If asking for a raise, you’ll probably quote higher figures than you really want.

For instance, when buying a home, you’re the first to table an offer and conditions of the purchase.

It’s unusual for the seller to accept a first offer—they often make a counteroffer.

This kicks off the negotiation process in earnest.

In some cases, such as in car purchases, you’ll not be the first to make an offer. The price of the item you want will be displayed. Otherwise, the seller will tell you what it is.

In this case, you can ask the seller what the best price they can give you.

Step 3: Bargain

This is the time to discuss in detail to understand the position of each party.

In salary negotiations, you’ll clarify why you qualify for a raise. This involves showing your employer what you’ve contributed over the past year or so and what that meant for the company.

If negotiating a purchase, you learn what the seller is really selling—what their offer includes.

This step is crucial and requires controlling your emotions. For example, you need to listen actively and not interrupt when the other party is speaking.

Doing so can give you an advantage as the more the other party speaks, the more they share that you can use for your benefit.

After a back-and-forth discussion, you’ll reach a win-win outcome. Other times, you’ll not reach an amicable agreement.

In this case, no transaction will take place.

Step 4: Conclude the Negotiation

Irrespective of the outcome of the negotiation process, this step is still important. You need to thank the other party for their time.

This might not be the last time you enter into negotiations with this party. Therefore, look at the interaction as the start of a long-term relationship.

Sometimes, you never really know what can happen soon after failing to get what you want. The other party might call you and give you a good deal.

If you’ve reached an agreement, you need to agree on the next steps. Most importantly, it should be clear who is responsible for what and the timelines involved.

Sometimes, you need to sign a contract right then, especially when buying an item like a car or home.

Tip #3: Create Multiple Income Sources

This is perhaps the most powerful method of increasing your savings. There’s one vital reason I’m saying this…

There’s no limit to the amount of money you can earn.

Contrasting this approach with cutting expenses, there’s no doubt that this is better. You can only cut your expenses by so much and no more.

If creating extra income in multiple ways appeals to you, here are some ways you can get started right away…

Launch an Online Business

Millions of businesses make money online. The message is clear: You can do so, too, provided you know how.

The good news is that your online business, depending on the type, can make money 24/7. You can have customers all over the world. And the cost of starting such a business is tiny relative to launching a physical business.

Platforms such as Big Cartel, Etsy, Amazon, and many others provide great and simpler means of starting an online business.

If you need a guide that can help you get started with operating an online business, go over this one from Oberlo.

Get a Freelance Gig

Amazing as this may sound, you already have skills that you can start monetizing tomorrow.

Don’t believe me? Head over to websites such as Guru.com, Upwork, Fiverr, and Freelancer.com, and you’ll be convinced.

Are you adept at selling, there are freelance jobs for you. Can you write a book? And you can, there are thousands of gigs for people like you.

Are you a marketer, why not go to one of the sites I mentioned above and find a gig?

If you’re good at web design, graphic design, or software development, you’ll find jobs that need your skills.

Pay often varies based on your customer and the scope of work.

Launch a Blog

In fact, you can start a blog about any topic as long as there are people seeking ideas, information, and knowledge in your industry.

Even if you’re an accountant, you can run a blog about accounting, teaching about income tax and various types of taxes. You can also choose to share content about business accounting.

Are you good at spreadsheets? You can create a blog that teaches people spreadsheet skills.

For inspiration, go over to YouTube and browse for blog ideas in your field.

A search engine such as Google or Bing can provide you with more details about what people in your industry want to know. You simply create a blog that answers those questions.

However, a blog can take a couple of months to earn you money. The good news is that you can use it to earn money in many ways.

For instance, you can become an affiliate marketer, sell advertising space, or create online courses to sell.

Your blog may be a marketing instrument for your skills. For instance, if you’re an accountant, you might get jobs filing taxes for small businesses, if that’s your expertise.

Once you start making money, it can go on for a long time.

Offer Private Tutoring Lessons

Are you passionate about education? Or, perhaps your job is to teach maths, science, accounting, or English at a school?

In either case, you can make extra money as a private tutor. You can start your own lessons online or offline.

Finding students to tutor isn’t difficult. Simply contact schools and ask them to inform students that you’ve started online lessons.

If you want to test your skills first before running your own private tutoring lessons, you can create a profile on one of the many platforms online.

Some of the popular websites include BrightSparkz Tutors, Turtlejar Tutors, Teach Me 2, and TutorsSA.

If tutoring locally isn’t attractive, you can offer your services to foreign students. Check platforms like Care.com or Tutor.com for opportunities. The advantage is that some foreign markets pay a lot better than locally.

Tip #4: Save Your Salary Raise - Don't Spend It

You probably get a salary raise annually, am I right? Many people increase their spending to match their new salary. For instance, they may upgrade their wardrobe, car, furniture, and phone. There’s a name given to this kind of behaviour.

It’s called lifestyle creep—also called lifestyle inflation. And there’s evidence that this happens as discussed below.

What it does is make you feel richer. Due to this feeling, you may have the urge to showcase how wealthy you feel.

Thus, you may buy more expensive items. The problem is that it prevents you from saving enough, whether for retirement or any other goal.

It’s worth realising that your savings force you to downgrade your lifestyle during retirement. If you can maintain a certain lifestyle and keep increasing your savings, you can live the same kind of life at retirement.

Why does lifestyle creep happen?

To answer this question, researchers at the University of Calcutta designed a study to figure out why lifestyle creep occurs.

This study discovered that indeed lifestyle creep does occur. The cause isn’t difficult to agree with.

The researchers found that lifestyle creep happens as a result of consumerism marketing and push selling techniques.

Companies have primarily stopped waiting for customers to discover and buy their products. Instead, they use techniques such as social media advertising, search engine advertising, and public relations techniques to popularise their products.

And this started many years ago due to groundbreaking work by men such as psychologist and expert marketer Ernest Dichter and Claude Hopkins, the man behind scientific direct response marketing and author of Scientific Advertising.

It’s up to you to decide whether your financial life will be dictated by marketers or by you. I’m sure you’ll choose wisely.

Tip #5: Find a Higher-Paying Job

Another option is to find a job that pays more than your current salary. This may sound as if it’s difficult.

Granted, South Africa’s unemployment is astronomical. However, this doesn’t mean that there are no job markets for skilled professionals.

Companies are always looking for people who can help them solve problems blocking them from expanding.

The most important thing isn’t whether there are jobs out there but whether your skills are in demand.

If you’re confident in your abilities to make a difference in another company, dust your CV and get it out there. Who knows, you might wind up landing a higher-paying job and increasing your savings.

Conclusion

Reaching your financial goals will be easier if you save.

You have to first take responsibility for your finances to save money earnestly. Once you get started, make use of the HFMS technique to ensure you save regularly.

If you aren’t sure whether to save or pay off debt first, you learned that you should do both simultaneously.

You can increase the amount you save by earning more. Some of the ways to do this include getting a higher-paying job, negotiating, creating multiple streams of income, and saving your salary raises.

Finally, share your thoughts about this article in the comments section below. I’ll appreciate it, and others might learn one, two, or more things from you